Why Your Business Should Switch from PayFacs Like PayPal, Square, and Stripe to a Real Merchant Processor

- john turner

- Jul 8

- 2 min read

If you're using PayPal, Square, or Stripe to accept credit card payments, you're not alone. These PayFacs (Payment Facilitators) have become popular for their plug-and-play simplicity. But for many business owners, especially those who are growing, these platforms come with hidden costs, limited control, and serious risks.

Here’s why more businesses are making the switch to a true merchant processing partner—and why you should consider it too.

✅ 1. Avoid Frozen Funds and Account Holds

One of the biggest complaints about PayPal, Square, and Stripe is the risk of sudden account holds or frozen funds. These PayFacs have full control over your account and can delay or deny access to your money—sometimes without warning.

With a dedicated merchant processor, your account is underwritten properly from the start. This means fewer surprises, more stability, and a clear relationship with your provider. You get more control over your money, not less.

✅ 2. Lower Your Processing Costs

PayFacs charge flat rates that seem simple—but they’re usually higher than necessary. Businesses are often paying 2.9% + 30¢ per transaction, regardless of card type or volume.

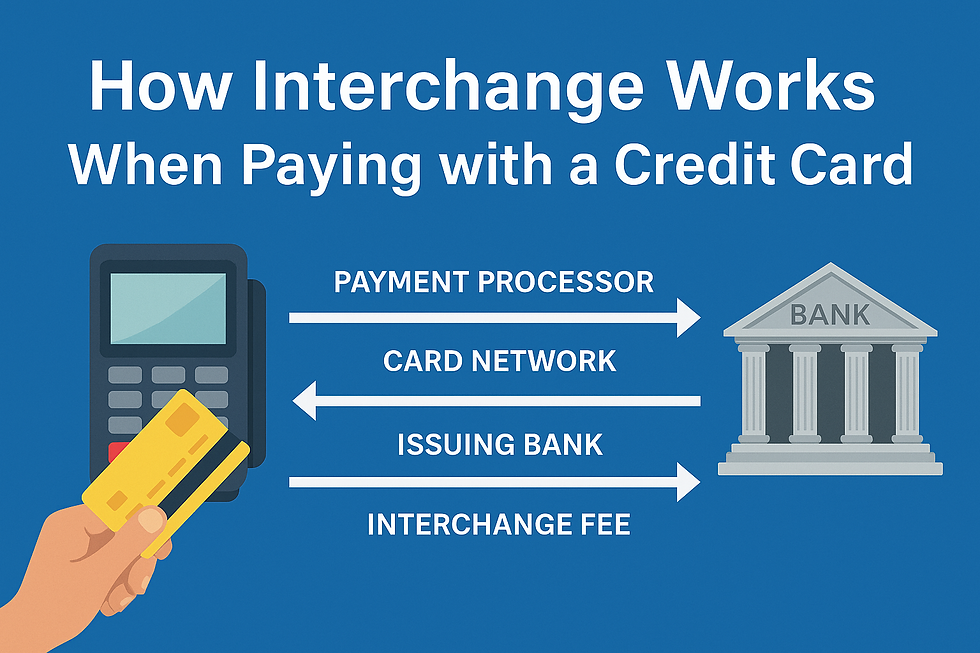

A real merchant processor gives you access to interchange-plus pricing or even zero-fee programs, where your customers absorb the processing cost. That can mean huge monthly savings, especially for growing businesses.

✅ 3. Better Customer Support (from Real Humans)

Try calling PayPal or Stripe when something goes wrong. Most support is automated, outsourced, or requires long wait times.

With a real processor like Wholesale Processing Systems, you get human-to-human support, a dedicated rep, and even direct access to the tech team. That’s critical when payments are down or you need urgent help.

✅ 4. Custom Hardware and Software Solutions

PayFacs give you limited tools—usually a mobile swiper or a basic online cart. But real-world businesses need more: countertop terminals, POS systems, advanced gateways, mobile devices, QuickBooks integrations, and more.

A merchant processor works with your business model, not against it. You get the right tech for your operation, not a one-size-fits-all solution.

✅ 5. You Look More Professional

Your customers know the difference between a “PayPal” link and a fully branded, professional checkout experience. Using a true merchant account with your own business name on receipts builds credibility and trust.

The Bottom Line: Stop Overpaying for Convenience

Yes, PayPal and Stripe are easy to set up—but that convenience comes with a price:

Higher fees

Limited support

Account instability

Fewer options for growth

A real merchant processing partner gives you lower costs, better control, and real support—without sacrificing convenience.

Ready to Upgrade?

Switching is easier than you think. Schedule a free consultation with Wholesale Processing Systems today and take control of your payments—on your terms.

Comentários