How Interchange Works When Paying with a Credit Card

- john turner

- Jul 8

- 2 min read

If you’re a business owner who accepts credit cards, you’ve likely heard the term “interchange.” But what exactly is it, and how does it impact your bottom line? Understanding how interchange works is essential to managing your credit card processing costs and choosing the right provider for your business.

Interchange refers to the fees paid by your business—the merchant—to the customer’s credit card–issuing bank every time a card is used. These fees are set by the card networks like Visa, Mastercard, Discover, and American Express, and they serve as the foundation of every card transaction. Regardless of who your processor is—whether it’s Square, PayPal, Stripe, or a traditional merchant services provider—interchange fees always apply.

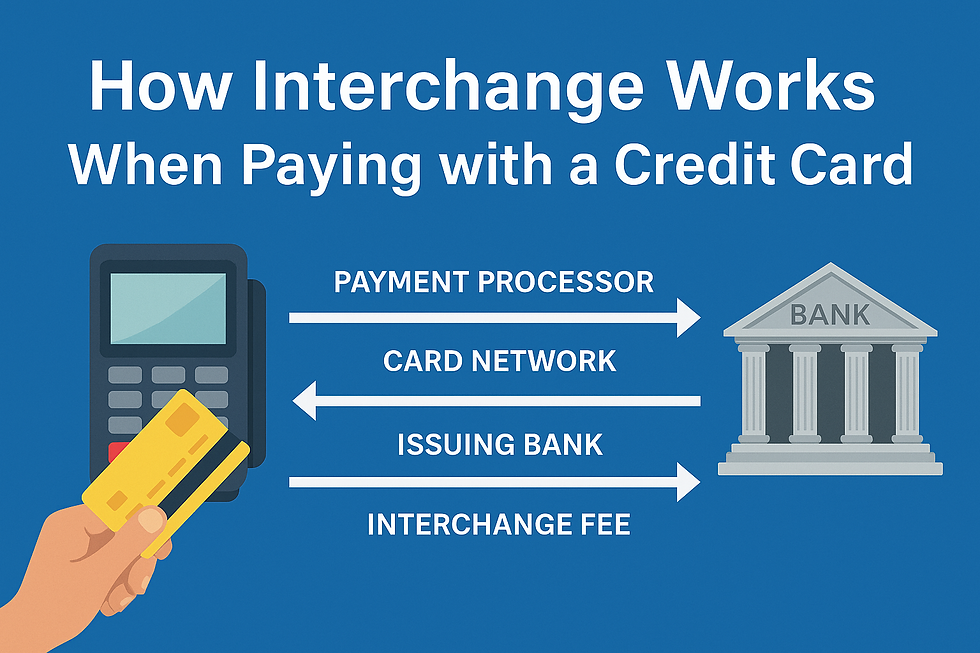

Here’s how the process works. When a customer pays with a credit or debit card, the transaction is sent through a payment processor to the card network, which then communicates with the cardholder’s bank (the issuing bank). If the bank approves the transaction, it transfers the funds—minus the interchange fee—to your business account. The entire process only takes a few seconds, but behind the scenes, several steps and entities are involved.

Interchange fees aren’t flat; they vary depending on multiple factors. The card type plays a big role—basic debit cards typically have lower fees, while premium rewards or business credit cards come with higher costs. How the transaction is processed also matters. In-person swipes tend to be cheaper than online or manually keyed-in transactions. Your industry classification (also known as a merchant category code, or MCC) and the size of the transaction can also influence the interchange rate.

To put this in perspective, if you’re paying a flat rate of 2.9% + 30¢ through a platform like Stripe or PayPal, a large portion of that fee is going toward interchange. The rest is split between the card networks (for assessments) and the processor (for markup). This means you’re often paying more than you need to, especially when flat-rate pricing doesn’t reflect the actual interchange costs of each transaction.

Understanding interchange is powerful because it allows you to make better decisions about your processing model. A traditional processor offering interchange-plus pricing shows you the true cost of each transaction plus a small, fixed markup. It’s transparent and often far more cost-effective than flat-rate options. Even better, many businesses are now switching to zero-fee or dual pricing models, where the cost of processing is passed to the customer—legally and compliantly—eliminating the merchant’s processing fees altogether.

In short, interchange is the unavoidable cost of accepting card payments, but how you manage and minimize that cost depends on your processing partner. With the right setup, you can keep more of your revenue, lower your expenses, and grow with confidence.

At Wholesale Processing Systems, we help businesses understand exactly where their money is going—and how to save more of it. If you're tired of high flat-rate fees or hidden charges, schedule a consultation with us today and see how much you could be saving by switching to a better processing solution.

Let me know if you’d like this turned into a printable PDF or optimized for email/newsletter format.

Comments